What Makes Singapore The Preferred Place To Start A Business?

If you wonder if this is the right time to opt for company registration in Singapore? Then the answer is "Yes, it is!" Maybe knowing a few more things about why other entrepreneurs prefer company registration Singapore will clear the way for you.

Why Opt for a Singapore company setup?

Almost all of the countries have suffered due to the COVID pandemic. It has made people sceptical about their entrepreneurial dreams. However, you need to consider that a few of the countries are showing healthy recovery.

Singapore is on the right recovery track. It is cashing in on the strength it can leverage from its world-class infrastructure, communication networks, excellent harbours and airports offering connectivity with the outside world and strong startup ecosystem.

How to Register Company in Singapore for foreigner and Local Individuals

Accounting and Corporate Regulatory Agency (ACRA) acts as the Company Registrar of Singapore and governs all aspects of companies. You need to apply to ACRA to register a company in Singapore for foreigner or local entrepreneurs.

The process for Singapore company setup is highly streamlined. It is short, swift and has only 2 procedures.

Firstly, you have to register your company name with ACRA. You need to pay $15 in ACRA fees.

Secondly, you have to apply to ACRA for the company registration Singapore. Official ACRA fees to do so is S$300.

Setting up a company in Singapore for foreigners or, for that matter, for local business owners takes only 1-3 days. The residency status of the company depends on whether or not you choose to manage it from Singapore. You, as a foreigner, are allowed to own 100% of your company's share capital.

If you are a foreigner, you can either relocate to Singapore or choose to manage your company from your native place. For relocation and to work in Singapore, you will need to acquire an Employment pass. Your company secretary can apply to the Ministry of Manpower and get it for you. It will allow you to work as a foreign director of your company.

Setting Up a Company in Singapore for Foreigner

The basic requirements to register a Singapore company are easy to fulfil, even for foreigners. You need to be ready with:

At least one shareholder

Minimum paid-up capital of $1

At least one company secretary

At least one local director

Registered physical local office address

As a foreigner, you will need to supply ACRA with your incorporation and KYC documents, including your copies of your residential proof, passport, etc.

Singapore Startup Ecosystem

Singapore authorities really believe and invest in their startups. Local Singapore companies get tax exemptions that help them in cutting down their overheads in the initial periods. For the first 3 assessment years, the startups can claim 75% of tax exemption on their first $100,000 chargeable income. Next $200,000 are taxed at 50% of tax rate.

It is a significant saving that helps them take roots or a foothold in the market. To solidify their position, they can spend this saved money for various purposes like marketing campaigns, product research, market research, and customer research.

Singapore Corporate Tax

Singapore taxes are affordable. The corporate tax ranges from 0% to 17%. It is a single-tier tax which means that once a company pays its corporate tax, it can disperse tax-free dividends to its shareholders. There is no capital gain tax in Singapore. There is also no inheritance tax in Singapore. The authorities have made it easy for the taxpayers to pay their taxes.

Singapore Personal Income Tax

Singaporeans and permanent residents have to pay personal income tax at the resident rates. It is a progressive tax that ranges from 0 to 22%. The non-residents have to pay it at the flat rate of 15% or the resident's rate, whichever yields the high tax amount. Their tax residency depends on their work-stay in Singapore.

Cross-Border Trading

Singapore has signed numerous trade treaties with its trading partner countries. It has made cross-border trading easy for even small Singaporean companies. Avoidance of double taxation treaties helps businesses conduct their business without having to pay tax twice and deal with delays due to rules and regulations.

Operating Your Company from Singapore

Political Stability

Politically, Singapore is a stable country that can fuel and help you realise your dreams with funding, tax benefits, accelerator and incubator programs. The authorities here truly support small and new companies. They appreciate that Small and Medium Enterprises (SME) help keep the unemployment rate down.

Negligible Corruption

You can trust the Singapore government. As per the Corruption Perceptions Index 2012 prepared by Transparency International, it is one of the least corrupt government bodies.

World-class Airports and Harbours

Singapore has invested in its harbours and airports. This keeps it connected to the outside world and functions as an Entrepot facilitating trade between the East and West.

Singapore airports offer reliable air links to airports spread throughout the world, including the emerging markets in Asia. The airports are efficiently managed to cater to the needs of business travellers. There are no queues for immigration and customs desk and waiting for the luggage.

Singaporean harbours are part of the global supply chain and service more than 600 destination harbours spread worldwide. The supply chain is well supported by the logistical companies providing efficient solutions.

Secure and Clean Living

If you choose to live in Singapore, you can expect high levels of secure and clean living. The crime rate is low, and the law is efficient. Its social environment is safe to live in for the entrepreneurs and their families.

Excellent Education System

Singapore has heavily invested in its education system. It is home to excellent schools, colleges, and universities. As a result, it is a highly literate country.

If you plan to relocate your spouse and kids to Singapore after your new Singapore company setup, do not hesitate. There is no shortage of schools for the right students.

Public Transportation System

Singapore offers an efficient mass public transportation system. It is affordable and reliable. The trains are new and run with optimum efficiency and frequency. Owning a car in Singapore is costly, and most people rely on public transportation.

Yes, you are correct in going for company registration in Singapore. It is a trading economy that is focused on staying competitive. The country has the proper infrastructure, political and social stability, and financial networks to support entrepreneurs.

https://www.sbsgroup.com.sg/in....corporate-a-singapor

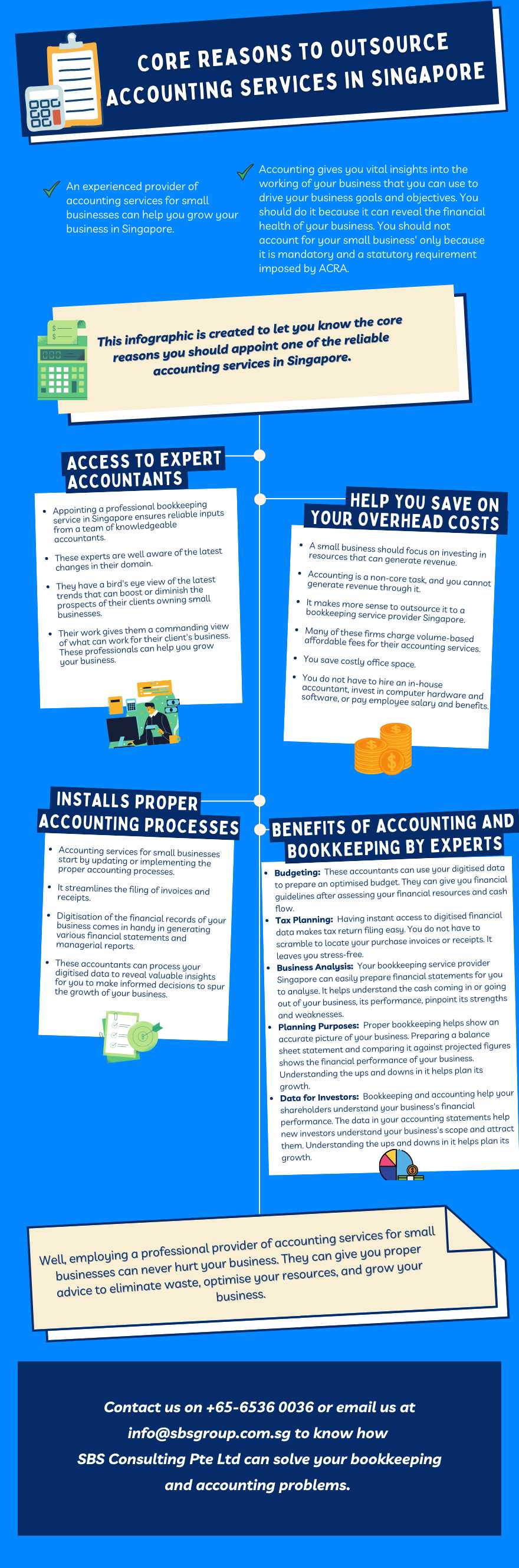

Its not a long time ago when businesses hire in house accountants to work over the financials and accounts management. With the technical incline, it has become possible to outsource accounting services to highly experienced professionals for enhanced productivity and efficiency for reaching business goals. Outsourcing accounting services in Singapore can save you a lot of money as you don't need to hire an in house permanent employee, provides you highly experienced professionals and saved a lot of time.

https://www.sbsgroup.com.sg/si....ngapore-accounting-s

2022 Foreigner’s Guide for Registering a Company in Singapore

Company incorporation in Singapore is trending. The company incorporation process is straightforward and short. Nowadays, aspiring business owners are searching for info on whether there is any way to register a company in Singapore for a foreigner without leaving their native country.

The business owners prefer to start an offshore company in Singapore. The country plays the role of an entrecote and an integral part of the global supply chain. Infrastructure-wise, it is an advanced country, and its network of trade agreements makes it a perfect place for new company incorporation.

Individual entrepreneurs can register a Sole Proprietorship, General Partnership, Limited Partnership, Limited Liability Partnership (LLP), and Private Limited Company or Pte Ltd. The partnerships and proprietorships can be registered in about a day.

The company incorporation services providers offer excellent advice and support for setting up a Singapore company for foreigners. Generally, it takes only 1-3 days to complete company incorporation in Singapore. Let us see the options available to foreigners in detail.

Private Limited Company

The business owners favour private limited companies. These are credible, dynamic, scalable and accommodate an expanding business's needs.

The foreigners need to complete pre-incorporation requirements for starting an offshore company in Singapore. They are as follows:

At least 1 shareholder

At least 1 local/resident director

Minimum initial-paid capital of S$1

At least 1 company secretary

Registered physical office address (Post Box address is not valid)

Option 1#

Incorporate Offshore Company & Acquire Employment Pass

You. as a foreign owner, need to appoint a company incorporation services provider who knows how to register company in Singapore for foreigners. You will need to hire a local/ resident director or pay for nominee director service.

After the company incorporation in Singapore, your company, as an employer, can apply to the Ministery of Manpower (MOM) for your employment pass. You need this pass to relocate and work in Singapore. You can remove the nominee director and act as the company's director.

To get your employment pass, you will need to earn at least S$8,000 in fixed monthly salary, have acceptable education qualifications, and a job as a managing director, CFO, or CEO.

Option 2#

Get an Entrepreneur Pass & Opt for Company Incorporation

Entrepreneurs who want to set up an offshore company in Singapore can also apply to the MOM and acquire an Entrepreneur or EntrePass for them. Those who have recently registered a Singapore monthly (less than 6 months old) can also apply to MOM and acquire EntrePass.

Afterwards, they can appoint a provider of services of company incorporation in Singapore and get it done. The entrepass enables you to act as the director of your company.

Anyone can apply for entrepass, provided they meet the following conditions:

I have already formed or intend to form a private limited company in Singapore with ACRA. It should not be more than 6 months old on the date of the entrepass application.

You can apply as a serial entrepreneur, innovator or investor for EntrePass. The requirements for each of them are as follows:

Entrepreneurs

To qualify for an entrepass you need:

At least $100,000 from a government agency, venture capitalist (VC) or business angel, known to Singapore Government agency

Your company is a participant of an incubator or an accelerator program

You have a solid track record as an entrepreneur

Innovators

You need to fulfil following requirements:

You own intellectual property (IP) rights and an advantage over your competitors

You have a research collaboration with a Singapore Government’s agency

You have a domain expertise

Investors

You want to invest capital in local tech startups. You need to submit documented proof:

Record of investments in highly-scalable companies

Should have worked in a large corporation for a minimum of eight years as in a senior role

Option 3#

Pay for Nominee Director Services & Register Your Company

If you cannot manage a local/ resident director, then get nominee director service from one of the company incorporation services providers. Provide them with the necessary incorporation documents and get your company registered.

A nominee director acts as an employee of the company and has no decision-making authority. They fulfil a mandatory requirement.

Prepare Documents to Set Up Singapore Company

ACRA approved company name

Description of business activities

Registered office address in Singapore

Particulars of shareholders, directors, company secretary

Foreign Entrepreneurs: Submit a copy of their passport and residential address proof (overseas)

Foreign Companies: Submit a copy of M&AA or Company Constitution

Singapore Residents: A copy of their Singapore Identity Card

After your company incorporation in Singapore, you will need to do a few tasks before starting your business activities. You will need to acquire business licenses and permits, open a corporate bank account, pay statutory contributions.

It is easy to open a corporate bank account in Singapore. There are local as well as international banks. Some of them insist on the physical presence of the shareholders and directors of the company at the time of opening a corporate bank account.

A few of the banks have moved on and are now allowing opening a business account online with a highly personalised Business Debit Card.

So, now, you can register an offshore company in Singapore without being present in the country. All you need to do is submit your incorporation and KYC documents to your company incorporation services provider and, afterwards, open a corporate bank account online.

https://www.sbsgroup.com.sg/si....ngapore-goods-and-se

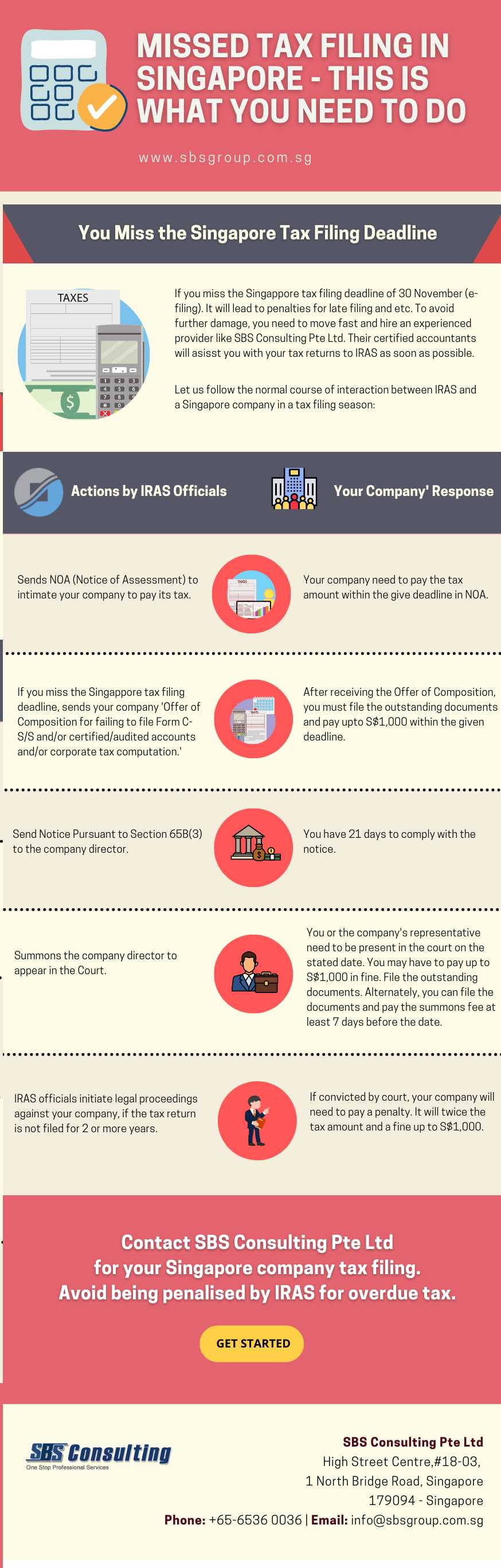

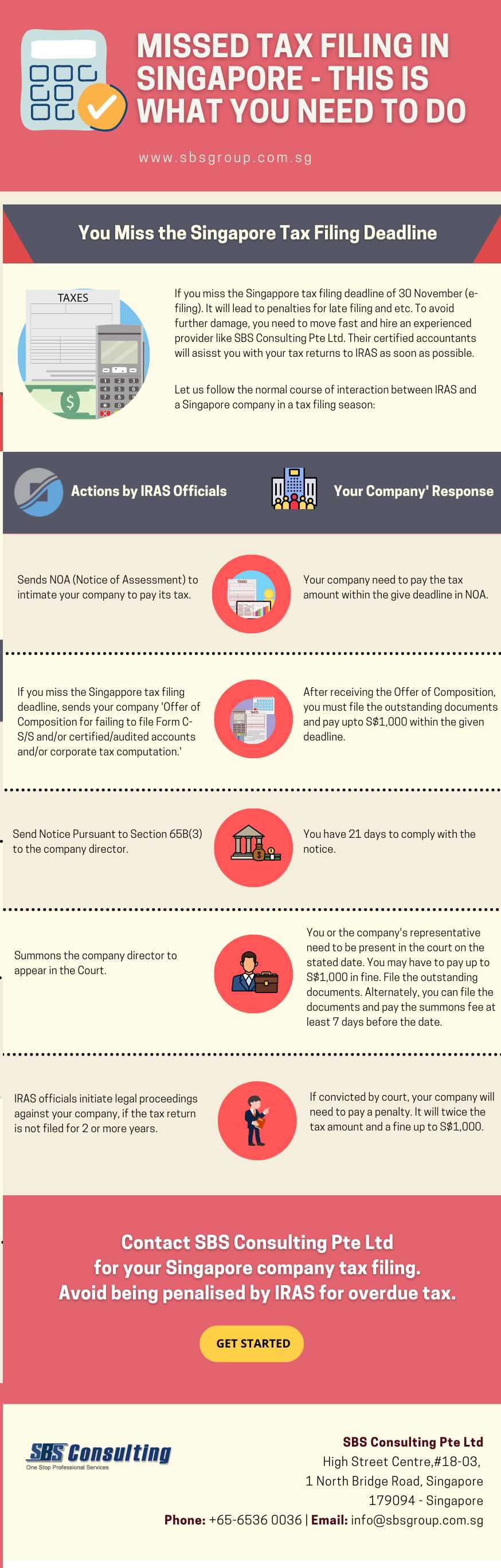

Singapore companies have to be on their toes to ensure their compliance. ACRA holds company directors responsible for it. taxation services Singapore

They are also responsible for planning and Singapore tax filing within due dates. Many of them appoint Singapore tax services for the task. The company directors have to prepare audited or un-audited accounts, tabling them to the AGM, and submitting them to the ACRA. The providers of taxation services Singapore, like SBS Consulting Pte Ltd, assist them in tax planning and filing.

https://www.sbsgroup.com.sg/co....rporate-tax-services

Things to Do After Incorporation of a Company in Singapore

You have to complete a few tasks after incorporating your Singapore company and starting your business activities. You need to set up statutory registers and open a corporate bank account. Experienced accounting services in Singapore can help you set up bookkeeping and accounting processes.

A provider of taxation services in Singapore can assist you in registering for taxes likes GST and corporate tax and in tax planning. You also need to order a company seal, acquire business licenses and permits, pay the statutory contributions, take out business insurance, and buy or rent an office space.

Tasks to Complete After Company Incorporation

After Singapore company incorporation, complying with your statutory obligations helps streamline your workflow. If you are a first-timer, these post-incorporation activities may seem daunting at first. However, a professional corporate services provider can take the bite out of it.

Appoint At Least One Company Secretary

It is mandatory to appoint at least one qualified company secretary within six months of your company's incorporation. You need to find someone ordinarily resident of Singapore who has knowledge of Companies Act and experience of acting as a corporate secretary.

You need to choose someone who is either a:

Singaporean or permanent resident

Singapore Employment Pass or EntrePass or Dependant Pass holder

The company secretary acts as the chief compliance officer of your company.

Appoint At Least One Auditor

Unless you are exempted, you need to appoint at least one auditor within three months of the incorporation of your company. The companies tagged as 'Small Company' qualify for audit exemption.

Open a Corporate Bank Account

Opening a corporate bank account in a local Singaporean bank can go a long in streamlining your expenses and earnings, i.e. cash flow. It will also help you in separating your personal and business finances.

A large number of international and local banks operate in Singapore. So, you have plenty of choices in banks. Select a bank depending on your business needs. Your bank may ask for the physical presence of authorized signatories and company directors for the task.

Acquire Business Licenses and Permits

Check if your business needs business licenses or permits to operate. Apply to the concerned authorities, pay the required fees and acquire them so that you will be free to get on with your business activities.

If you intend to import into or export goods out of Singapore, you must register your business with the Customs Department. A permit from the Customs department is mandatory for such companies.

Register for Goods and Service Tax (GST)

Your provider of accounting and bookkeeping services in Singapore can help you assess the need to register your business for GST.

In Singapore, businesses having projected or annual turnover over S$1 million must compulsorily register for GST. You can also choose to register your business for GST voluntarily. It will help you claim the input GST you paid on your business purchases.

Set Up Company’s Financial Year End (FYE)

You can practically set your company's FYE as you want. However, you need to be careful here as it can impact company's:

Annual filing reports

Conveying of the Annual General Meeting (AGM)

Estimated Chargeable Income (ECI) filing

A wrong FYE can affect your business' taxation. On this matter, you can take advice from the consultants working for taxation services Singapore. They can point out the tax exemptions and benefits your business can claim rightfully.

Issue Share Certificates

After incorporating your business, it is the responsibility of the company secretary to issue share certificates to its shareholders. Share certificates denote the ownership of a shareholder in your company. It can be issued with or without the company's common seal.

Company secretaries communicate with the shareholders and handle their queries. They are also responsible for keeping track of the number of shares issued to the shareholders and movements in shares. Ideally, as the company owner, you should own the majority of shares to be in the company's control and find finance for its growth in future.

Set Up Company's Statutory Registers

Company's statutory registers hold the legal records of your company. Your company secretary needs to compile and update statutory registers regularly.

As per ACRA's law, you have to store them at your registered office in Singapore. These are public records that IRAS or ACRA officials visiting your office can ask to inspect at any time.

Your company need to maintain:

Updated statutory register of company officers: auditors, directors and secretaries. It should contain their appointment and resignation dates

Details about your shareholders: number of shares they own and updated stock transactions

Details of company loans secured using fixed or floating charges and debentures

Minutes of AGM and resolutions adopted

Set Up Accounting System

Your provider of bookkeeping and accounting services in Singapore can help you in setting up an accounting system for your company. It is a vital task that you should perform on registering your business.

Though the present trend is to appoint an outsourcing accounting services provider, a well-built accounting system is essential in recording your business expenses and profits.

Regularly updated records are useful in understanding the company’s financial health and profitability. It is also a mandatory requirement imposed by ACRA. You also need to maintain your accounting books following the SFRS.

Purchase Business Profile for Your Company

The business profile describes your company. It contains details like company name, unique registration number, incorporation date, principal business activities, registered address and particulars of its officers.

Purchase and download the business profile for your company in PDF format within an hour of purchase.

Few Other Tasks to Take Care After Company Incorporation:

You need to purchase or obtain the following things after successfully forming your Singapore company.

If required, pay for the PDF version of the incorporation certificate of your company to print its hard copy.

Purchase and distribute share certificates to company's shareholders

Order and pay for Company Seal or Common Seal

Order and pay for Business Cards

Get a Business website, i.e. suitable domain name registration and email addresses

Order and pay for Invoice book, Company Letterhead, and other official documents. Make sure to print the UEN of your company on it

A professional accounting services provider or a registered filing agent can help you immensely in registering your company. They can also guide you in completing the post-incorporation tasks to ensure compliance. It is a great help if you are new to the Singapore business environment or a first-time business owner.

https://www.sbsgroup.com.sg/in....corporate-a-singapor

1 (877) 773-1002

1 (877) 773-1002